21 Aug 2023

One for the ages – commercial property loans made abundantly in a lower interest rate environment are facing a historical dilemma as rate hikes dramatically increase the cost of debt amid falling valuations. Debt servicing and refinancing are storms to be battled as tenants are uncertain about future occupancy needs.

Over the last year, we witnessed European commercial real estate’s returns deteriorate and slide to record levels in the third quarter of 2022, posting the worst performance since the 2008 global financial crisis, according to the MSCI Europe Quarterly Property Index. Rising interest rates and slowing economic growth meant total returns sank to -2.2% at the end of September, down from 2.5% in June. This was a notable moment as the largest quarterly shift in the index’s history and was the worst total return since December 2008, when the figure was -6.4%. European Commercial Real Estate’s Returns Show a Slowdown – MSCI.

The results indicate that a widespread slowdown in Europe’s commercial property market is underway.

During the pandemic, the corporate world asked its staff to work from home. According to Erica D’Souza from Colliers, “Forty-plus years into personal computing, many thought the introduction of the smartphone meant that people could now work anywhere, but it took a global pandemic to really change the culture of the built environment.” Now the market is shifting, and we are now seeing many large corporations urging employees to return to office-based working.

The transformative impact of hybrid work patterns has led to a shift towards a tenant-focused environment. A hybrid work culture has evolved, in which people expect more from their living and working spaces. To this end, companies may be driven to seek out higher end office space to entice employees back to the workplace. Companies retaining hybrid arrangements may be looking to seek smaller, more agile workspaces to accommodate reduced employee occupancy.

Otherwise, uncertainty dominates. The purpose of the office remains a question mark for some as altered work patterns have changed the landscape and demand for office space. Half of big multinationals plan to cut office space in the next three years with the largest number aiming to reduce space by 10 to 20%. US office vacancy rates are currently at 19.6% and rising compared to a more stable 7.4% across Europe. The risks now present in the US market come from the sheer size and scale of the buildings, which are typically larger towers that cannot easily be converted to residential or other use.

European banks have less exposure to commercial real estate (CRE). EU lending for commercial real estate is approximately 7%. In the US, CRE lending is at 13% and with 6 times the exposure that equates to a staggering 43% of the loan book for smaller and regional US banks.

The collapse of regional banks that house these loans took the US by surprise and, as a result, has become a prime concern for the sector. European commercial real estate remains more robust than US (Fidelity.lu)

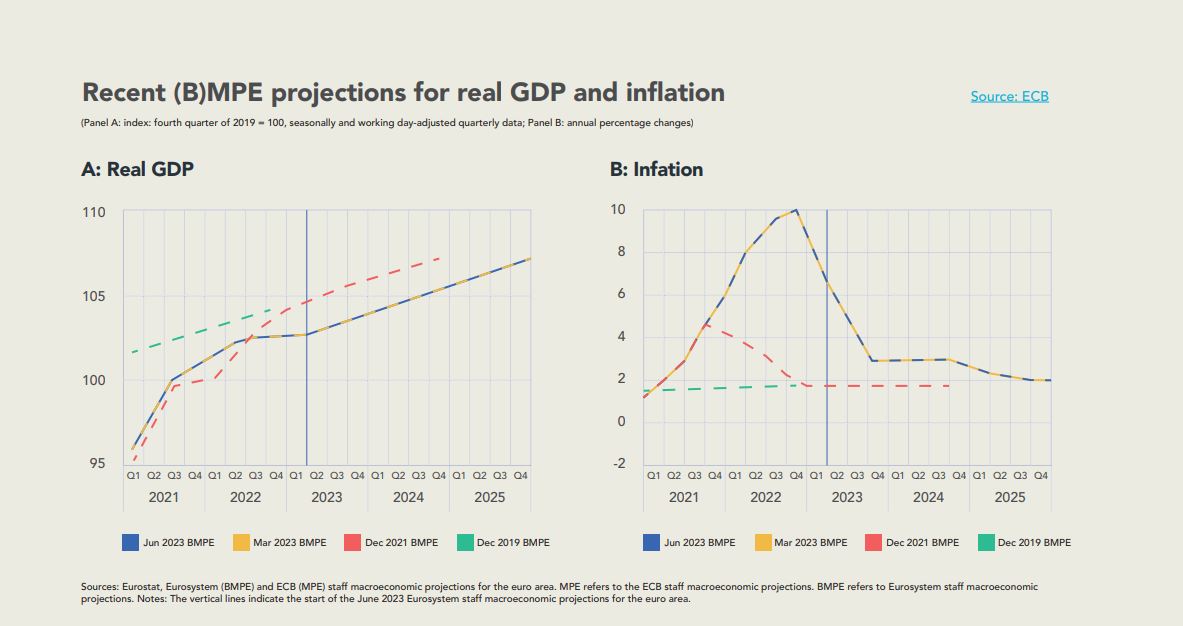

European Economy – The ECB once again raised interest rates in late July by 25 basis points. The rise stands as the 9th consecutive rate hike to increase the cost of borrowing since the program began in July 2022. The increase in rates of 425 basis points is the fastest tightening pace in history for the ECB.

Slowing demand for business loans in the second quarter and a sharp contraction in business over July suggest that the European economy is slightly depressed. Christine Lagarde, President of the ECB considers pausing rate increases in the next September

meeting. Lagarde, though, has been very clear that a rate cut will not be on the table as the ECB is intensely focused on mitigating inflationary pressures. Previously, economic output in the euro zone dropped 0.1% in both the final three months of 2022 and first quarter of 2023, according to Eurostat.

Inflation in 2023 thus far remains well above the ECB’s target of 2%. Current adjusted predictions are 5.1% on average in 2023 before declining to 3.0% in 2024 and 2.3% in 2025. The inflation outlook and monetary policy in the euro area (europa.eu)

Overall, the ECB has not raised rates as aggressively as the US, which also raised rates in July by a quarter of a percentage point, pushing the rate up to the nation’s highest level in 22 years. Initially, the ECB lagged behind the US in raising rates only to see the Euro weakening against the dollar. The moves are unprecedented and have been particularly aggressive amid unusual circumstances in global economies as geo-political tensions, supply chain disruptions, energy prices and other headwinds hamper stability.

Euro economists expect the possibility for increased economic contractions in the months ahead. According to the Financial Stability Review published in May 2023 by the European Central Bank (ECB), Euro area financial stability is considered fragile, although earlier projections from the European Commission and the IMF (IMF World Economic Outlook update) did not forecast a recession in the EU or in the euro area for 2023 (ECB). A reduction in GDP growth of 0.7 percentage points is still expected during 2023. Economists are keeping an eye on loan demand and increased business contraction for the latter part of 2023.

The ECB remains committed that careful oversight and adequate management of NPLs are necessary for resilience and stability of the EU banking sector.

Confidence in the banking sector remains steady as NPL levels have continued to decline over the last year in 2022. As a matter of prudence, rising debt costs have been met with a tightening of credit standards throughout the Eurozone. Interest rate hikes that increase the cost of debt threaten the possibility of a higher number of defaults, jeopardizing credit quality, especially as values of properties decline. Further, the ECB states “unexpected deterioration in economic conditions or financial tightening could lead to disorderly price adjustments in either or both financial and real estate markets”. Financial stability outlook remains fragile, ECB review finds (europa.eu)

According to KPMG, “The current situation of high inflation and rising interest rates is already putting pressure on certain borrower segments. Signs of latent risk can be observed across asset classes (e.g., consumer finance, residential real estate), particularly in the level of stage 2 loans and with a slight increase in default rates towards the end of last year.”

For Europe’s top property investment firms, fair values of residential real estate portfolios are expected to fall by 10% by the end of 2023 and that’s despite the growth in rental income which will not be enough to offset the higher costs of debt. “However, the implications for credit quality remain modest. For many companies, even a 10% decline in fair values – recognizing that declines will vary within and between locations and residential property categories leaves plenty of equity protection because current loan-to-value ratios are typically between 40%-50%. In addition, real estate companies with significant residential exposure face real but manageable pressure on leverage ratios.” Scope Group.