20 Mar 2023

As European economies are in a general low growth period bordering on a mild recession, numerous individuals, and institutions with exposures to real estate and real estate loan collateral could become vulnerable in the months ahead. Although, a downturn now will likely not be as severe as the collapse of 2009 which resulted in systemic shock as troubled loans came to light.

Whereas NPLs have demonstrated a downward trend across the continent generally even as the events in Ukraine unfold, cautious optimism is still the correct approach concerning the future. While the lifting of the moratorium did not reveal an overwhelming cascade of defaults, the long-term impact of the pandemic is still not certain. Supply chain disruptions, inflationary conditions, and rising interest rates pose challenges for businesses and individuals who may not be completely in the clear without continued government support. Energy price increases are also uncertain and may continue to create additional pressures.

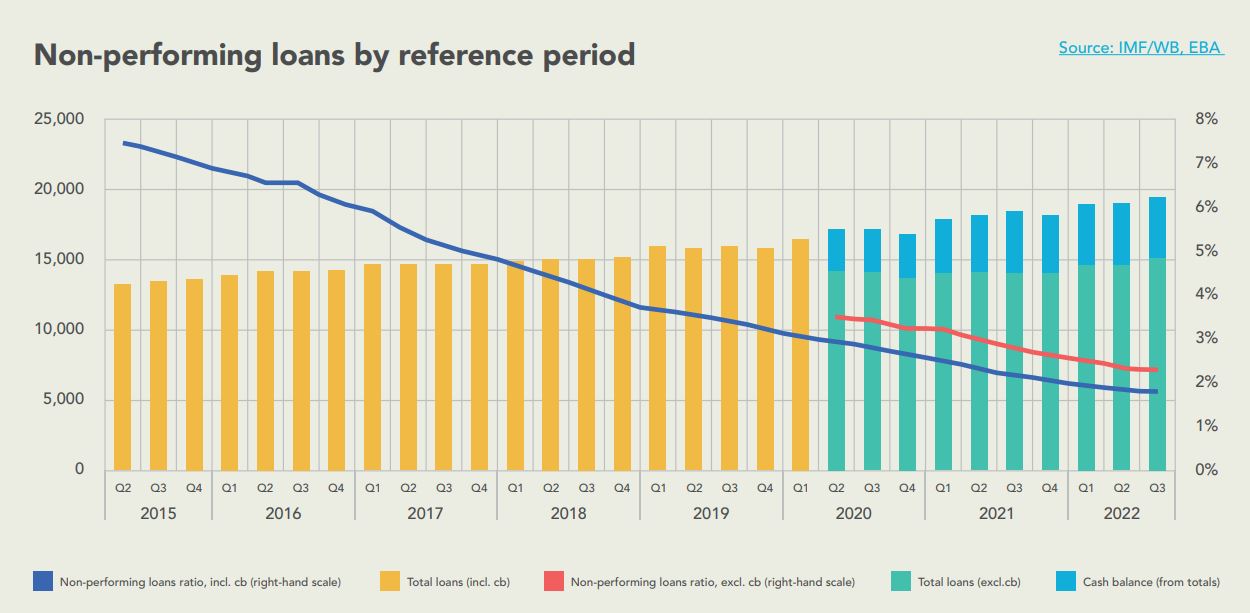

Brief – Overall, European banks have successfully deleveraged and have eliminated NPLs and UTPs, owing to regulatory initiatives, with the exception of recent UTP loans that will likely come to surface as recessionary conditions surface across the continent. Banks today, however, are better positioned to weather NPLs owing to higher supervisory standards, than they were in the Global Financial Crisis. In the graph below, the trend line clearly depicts NPLs in the EU on the road to recovery (source: IMF. WB, EBA). In the time period between 2014 -2020, the level of NPLs decreased markedly from trending above 6%, moving down below 3% by 2020. Currently, the EBA also maintains that banks comply in keeping the overall total NPE ratio below 5%.

Thus far, investors and asset managers have relied on relatively easier money as interest rates have remained low for quite some time. According to sources, approximately €1.9 or 2.1 trillion in USD is secured against commercial property or landlords across Europe. As 20% of these loans are set to mature this year in 2023, do we expect a wave that will put the regulatory attempts of the last decade to the test?

In Italy for example, we already see Italian banks’ new impaired loan ratio seen rising to 2.3%, and In 2023, such a rate is seen rising further to 3.8% before easing back to 3.4% in 2024. However, these levels are nowhere near as severe as the 7.5% peak seen a decade ago.

John Macdonald, Recognyte – Is there a real risk of a domino effect? It’s not clear that the risk of a domino effect is real, as there is greater resilience built into the financial system since the crisis triggered in 2008 and which led to massive NPL issues, particularly across southern Europe peaking in 2013-4.

Since then, banks have radically changed, offering them the ability to weather any impending storm in real estate values. Additionally, there is expertise and liquidity from investors who have entered the NPL markets since the last crisis, and have an appetite to take on challenging portfolios.

These factors lower the systemic risk and for a domino effect arising again. Banks have tightened initial evaluation of credit in the first instance, and the loan to value ratios which they are willing to offer. The current level of NPLs on their books today is low compared to 2012.

The EU wide ratio is less than 5%, and even in the problematic markets across southern Europe, NPLs have been taken off balance sheet (generally sold to new investors) and capital ratios have improved, offering resilience to an increase in exposure.

The emergence of a large number of investors who have built up expertise in managing NPLs (and the specialized services providers who support them) offers banks the ability to offload problems with limited and manageable impact to their balance sheet.

These new types of investors, often private equity houses, entered the market as they searched for larger returns for their funds in the then prevailing low interest rate environment, and access to large portfolios where significant upside returns might exist to be bold.

These investors simply did not exist 15 years ago, and their absence (together with instant new capital for the banks) led to the necessity for wholesale government support.

This said, in the event that there is a deep, deep crisis, governments may be less ready to step up with rescue packages with their own balance sheets stressed from pandemic measures, stagnant economies and domestic pressures to help their citizens through the effects of inflation!