09 May 2023

As the US Federal Reserve became aggressive in raising interest rates last year at a record pace, the ECB was much slower to act and trailed in raising rates in an attempt to curb inflation. As a result, in July 2022, the Euro reached a low of $1, a record number marking the lowest exchange rate in 20 years. While a weaker Euro helps European companies sell their products in the US, the weakening Euro is also problematic and acts to accelerate inflation in the Eurozone.

The Ukrainian war and higher prices for fuel and energy are also contributing factors as the US is primarily a producer of fossil fuel vs being a consumer only, adding to a weaker exchange rate. All the while, capital is flowing into the US to take advantage of higher interest rates. Collectively, the Euro then is losing value against the dollar.

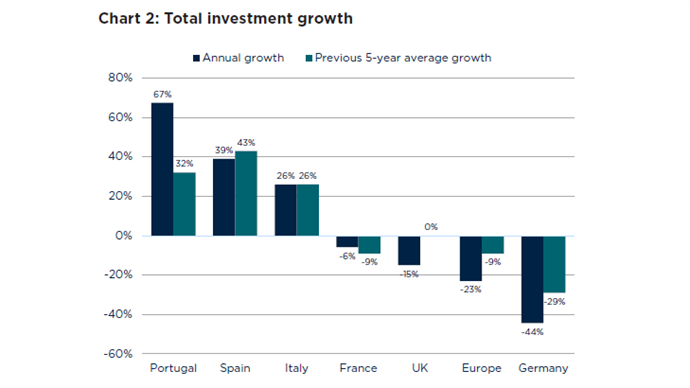

A shift is underway impacting the borrowing rate and value of the currency. Minus the upside of export opportunities, companies make fewer investments due to the increased cost of borrowing and overall, there is a decreased demand for capital goods. At a crossroads, investors and banks looking to minimize their risks in the real estate market must conduct thorough due diligence and possess a strong knowledge of their local real estate markets under these circumstances.

Following the 2008 financial crisis, many EU countries had to deal with a wave of non-performing loans (NPLs) that impacted their loan portfolios. Recognyte, in working closely with real estate across Southern Europe, is well placed to observe the different attributes and nuances of these markets through its experience and its wealth of knowledge built up from its transactional data.

“Despite today’s wider economic conditions and uncertainty that continue to threaten to disrupt the property market, there are some unexpected opportunities for investors who can still find ways to minimize risk and maximize returns, if they know their markets well,” said John Macdonald, CEO Recognyte.

In Portugal specifically, we see a widening of the affordability gap for local investors.

Hugo Branco of Addapters, an Independent Portuguese valuer states, “There is a distinct lack of middle-class properties available at prices that most Portuguese can afford as the Portuguese internal market does not have the purchasing power for luxury at these higher prices. Expats and those able to take advantage of the real estate sector and the Euro parity with the dollar are the primary consumers”.

“The Euro weakness is reshaping the investment profile and debt in Portugal, as it’s triggering a change in the usual type of investors looking for the country to invest in. A weak Euro makes exports less expensive, which can boost Portugal’s economy and attract more foreign investments, making it cheaper for foreign investors to purchase properties in Portugal as they get more value for their home currency”, added Branco.

Investment in a Tale of Two Cities? Retaining Value for Assets as the Euro Depreciates Discourages Use of Local Currency

“We may see a shift from institutional investors that are more cautious and investing longer term, with expectations for higher returns. These investors saw rising interest rates make their financing needs more expensive vs that of retail investors who are less sophisticated. The retail investors are more focused on the combination of yield and return plus the climate, lifestyle, and safety within the environment for what Portugal is well known for. The retail investors are also eyeing the right fundamentals and returns for a safe investment as a “hot spot” for their capital.

On the other hand, a weak Euro is also contributing to increasing inflation and interest rates, leading to higher borrowing costs and lower investor confidence, making it harder for the country to service its own debt, as it will have to pay back more in local currency for every Euro borrowed. “This environment may erode the value of savings and investments over time, and those who are looking to sell their properties or expecting returns from their real estate, may not get as much value for their assets as the Euro depreciates. The incidence of fewer domestic buyers due to economic instability is already a reality, slowing down the market,” added Francisco, Vice President and Country Head of Resolute Asset Management.

Together with increased interest and marketing efforts made by Turismo de Portugal in recent years have placed Portugal in the spotlight for real estate.

House prices for existing properties as well as new builds in Lisbon and Porto especially, have been skyrocketing in latter years, with new developments being sold rapidly at very high exit values. This has led to improved quality in architecture, interior design, and space solutions at the highest level, as has been seen in New York and London’s housing and office complexes. The real estate price increase has had a very positive effect on these developments.

Another phenomenon occurring in Portugal is the purchase of high-end housing units as non-liquid assets to hold, for investment. These units are not rented (or are only short-term rented) as a safe haven for capital, taking advantage of steady, continuous price rises. This is true for luxury housing units in paradigmatic developments, such as those in Lisbon city. The “lack of homes while many homes remain empty ” is a social phenomenon happening right now in Portugal. Recognyte’s Macdonald, however, in summary states “this is a risk to consider as the government may choose to take action to address this lack of occupancy, but we do not believe that a “Canadian style” ban on real estate purchase by foreigners will take place in Portugal”.

Good Reasons to Invest

Portuguese luxury real estate is high quality and is pricey, but the country offers good reasons to invest, especially if the Euro weakness persists. There is a potential risk of a bubble, mainly because of the current lack of substitute buyers should the Euro valuation suddenly change. If no setback occurs and Portugal’s economy continues to grow post pandemic, there are good reasons to be optimistic about investing in Portuguese luxury real estate.